Your Debt-Free Life, Secured!

Do it Yourself (DIY) Debt Settlement - Negotiate Smarter, Pay Less and Own the Process!

Why pay 18-28% in fees for someone to make the same calls you can make yourself?

Most debt settlement firms charge hefty fees and keep you in the dark. With DebtSettle.ai, you keep control — and keep the savings. We guide you step-by-step, generate your exact talking points and letters, and track every promise, payment, and document.

Lower Cost

You avoid the hefty fees (often 18–28% of enrolled debt) that traditional firms charge, keeping more of each settlement for yourself.

Control & Transparency

You drive the pace, choose which accounts to settle first, and see every step, offer, and agreement in one dashboard.

Better Execution

Built-in templates, call scripts, and negotiation trackers help you make credible offers, document everything, and avoid mistakes.

Staying on Track

Reminders, budget tools, and payment schedules reduce missed deadlines or broken deals—key to actually closing settlements.

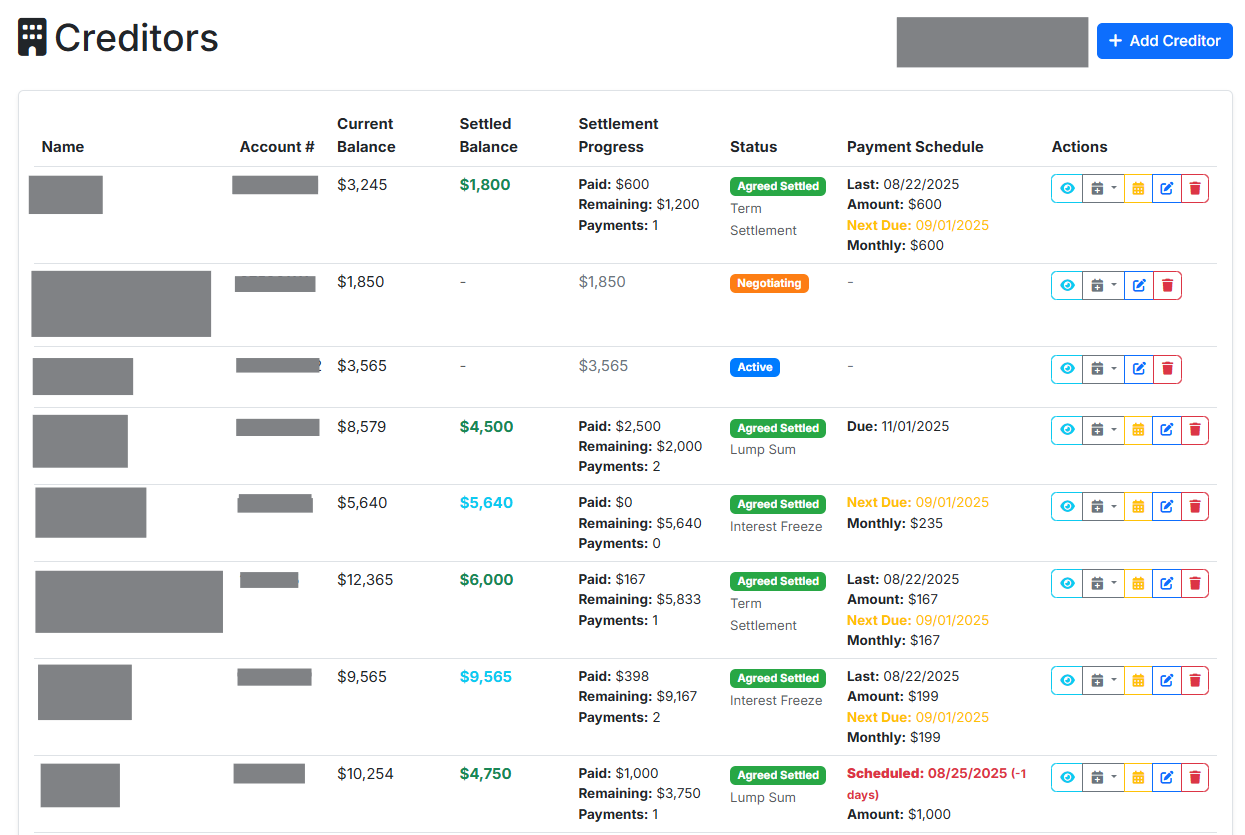

Easy, Intuitive Dashboard

Everything in one place — balances, offers, deadlines, and progress.

Add Creditors Database

Centralize accounts, and prioritize by best settlement odds.

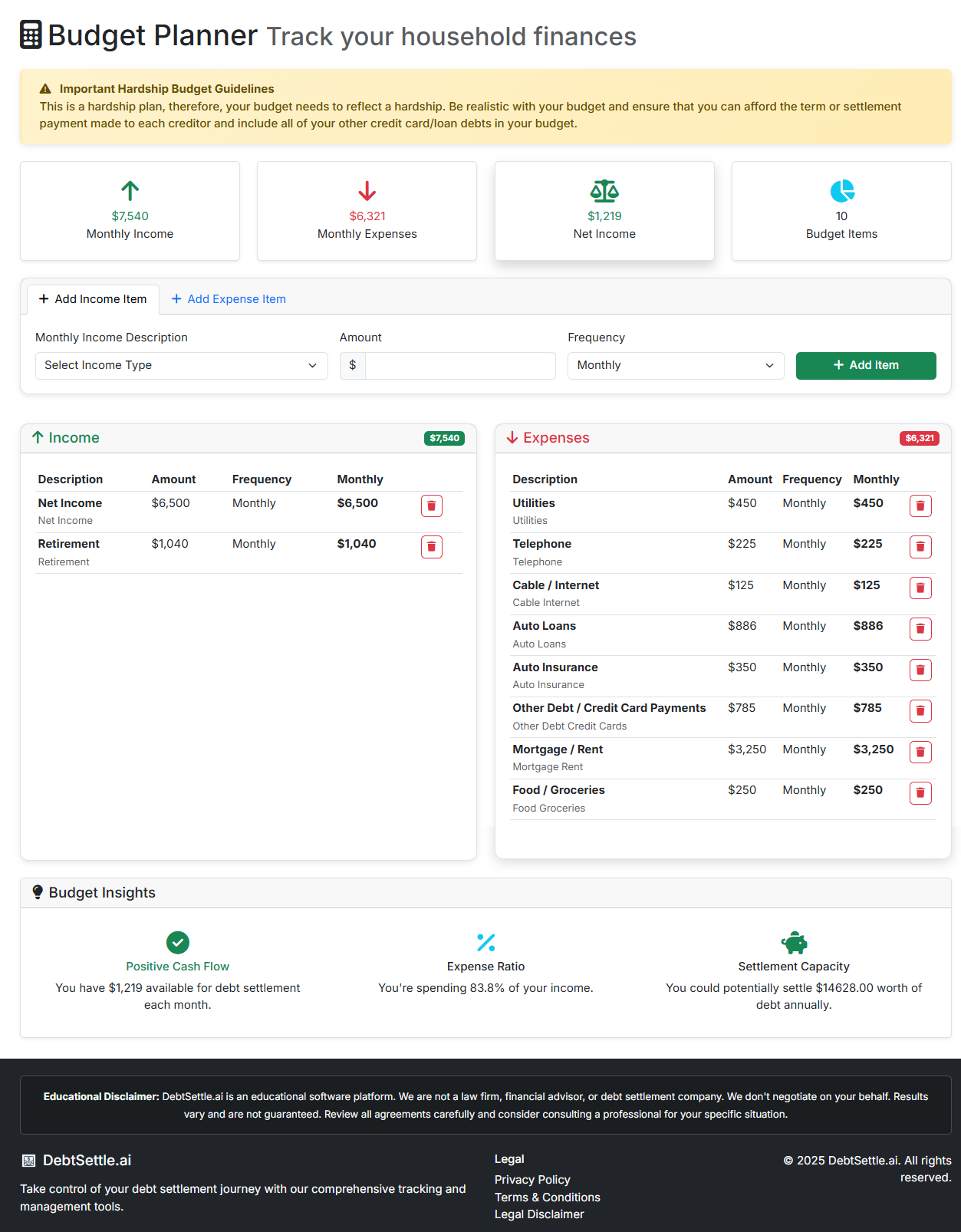

Budget Planner

Know exactly what you can afford to offer — avoid over-committing, avoid failed deals.

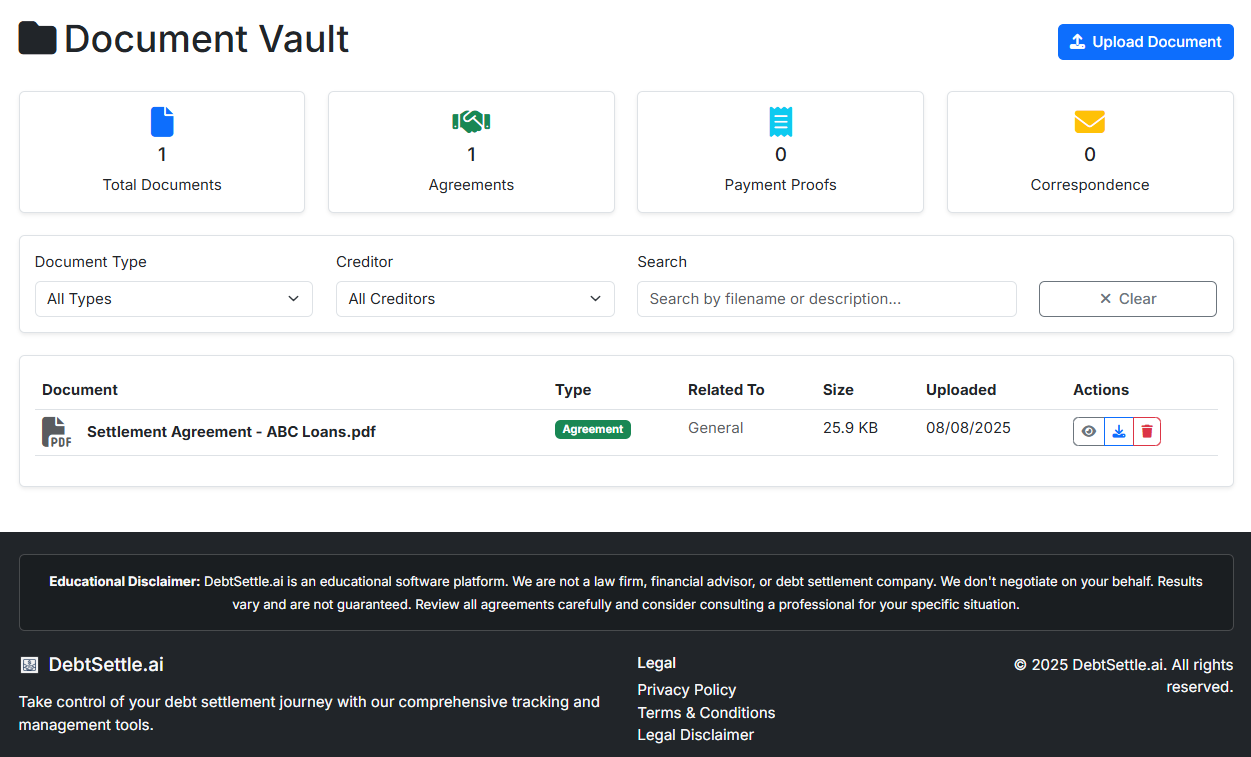

Secure Document Vault

Upload letters, settlement agreements, and receipts. Encrypted. Organized. Searchable.

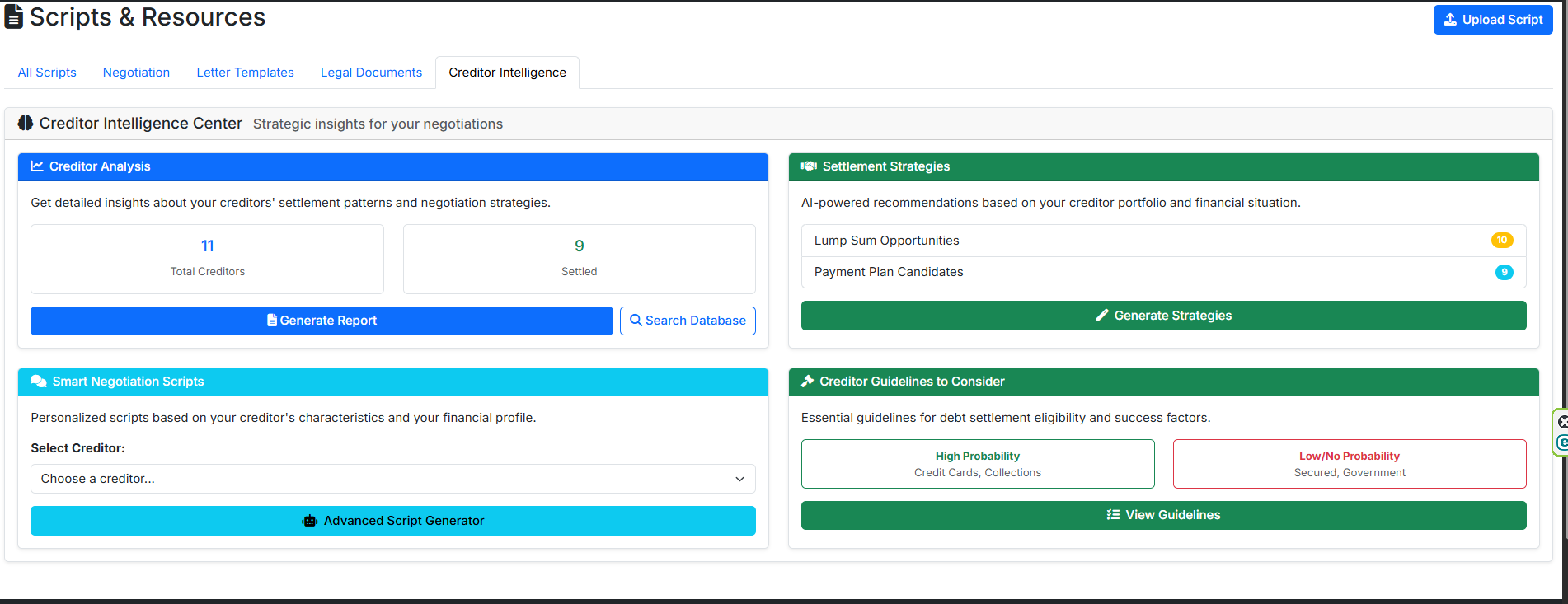

Creditor Intelligence

Guidelines and historical behaviors to help set realistic targets and avoid rookie mistakes.

AI Scripts & Letters

Talking points for first calls, counter-offers, hardship narratives, and final settlement letters — adapted to each creditor's style.

More than a debt tracker

Your debt settlement journey deserves professional-grade tools

Track Creditors

Manage all your creditor information in one secure place

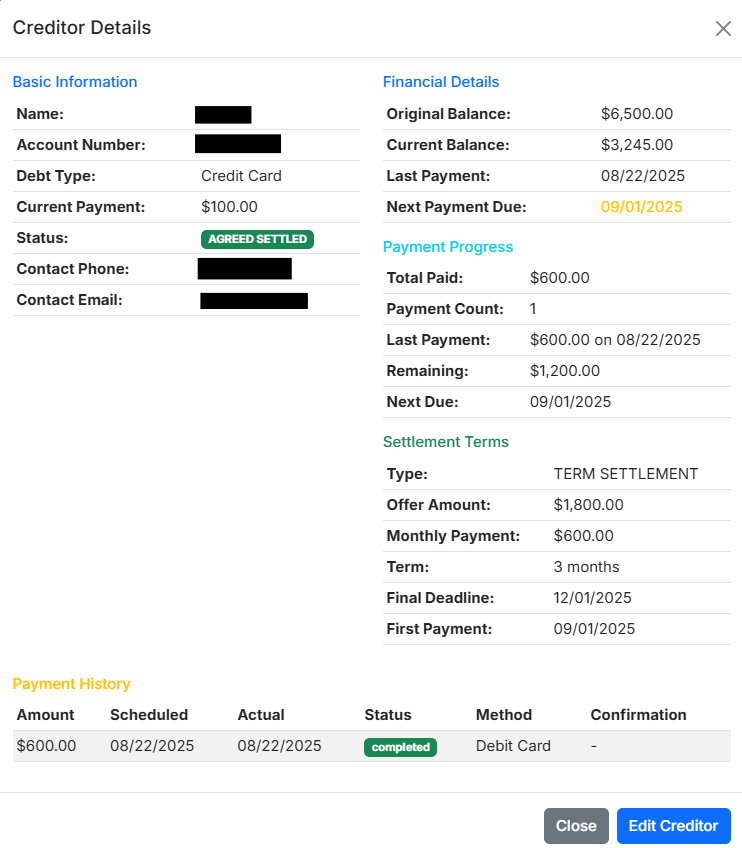

Negotiate Settlements

Track settlement negotiations and agreements

Schedule Payments

Never miss a payment with our scheduling system

AI-Powered Scripts

Generate personalized negotiation scripts based on creditor intelligence and proven settlement strategies.

Smart Analytics

Track your settlement progress with intelligent insights and predictive analytics for better outcomes.

Secure & Private

Bank-level security with encrypted data storage and two-factor authentication to protect your information.

Creditor Intelligence

Access comprehensive creditor data, settlement rates, and negotiation strategies from our extensive database.

Smart Scheduling

Automated payment reminders and calendar integration to keep you on track with your settlement plan.

Mobile Ready

Access your debt settlement tools anywhere with our fully responsive mobile-optimized platform.

How it Works in 4 Simple Steps

Read The Debt Settlement Playbook

Read the Debt Settlement Playbook for Financial Underdogs and Master the art of DIY debt negotiation with our comprehensive guide

Add your creditors

Enter creditor names, balances, contact details and status. We'll organize everything and flag "quick-win" targets

Get your tailored plan + scripts

DebtSettle.ai generates creditor-specific call scripts and settlement letter templates based on historical patterns and guidelines — so you know exactly what to say and send

Negotiate, track, and finish

Log offers, schedule follow-ups, store agreements in your Secure Document Vault, and use reminders so nothing slips

See DebtSettle.ai in action

Professional-grade debt settlement tools that put you in control

Get The Debt Settlement Playbook for Financial Underdogs

Master the art of DIY debt negotiation with our comprehensive guide - no subscription required!

- Learn proven negotiation strategies used by professional debt settlers

- Discover AI-powered tools to automate and optimize your settlements

- Get word-for-word scripts to reduce what you owe by 40-70%

- Understand your legal rights and protect yourself from collector tactics

- Over 90 pages of content to Master the art of DIY debt negotiation

COMPARISON - DIY w/ DebtSettle.ai vs Traditional Debt Settlement

See why DIY debt settlement with professional tools beats expensive third-party firms

| Feature | DebtSettle.ai (DIY + AI) | Debt Settlement Company |

|---|---|---|

| Fees | Low monthly software fee | 18-28% of enrolled debt |

| Control | You decide timing and offers | Company controls pacing & communication |

| Transparency | See every step, script, and letter | Limited visibility |

| Speed | Start today, no intake lag | Weeks to onboard |

| Customization | Scripts/letters tailored to your creditors | One-size-fits-many |

| Documentation | Secure vault + audit trail | Depends on provider |

| Motivation | Visual tracker + wins | Often "set it and forget it" |

Choose Your Plan

Start your debt settlement journey with our professional tools

Essential

Perfect for getting started with debt settlement

- Over 90 Page Guide - The Debt Settlement Playbook for Financial Underdogs

- Unlimited Creditors

- Credit Report Integration

- Payment Scheduler and Tracker

- Budget Planner

- Secure Document Vault

- Advanced Settlement Tracking

- Mobile-Responsive Design

- Access to Debtalyze Web App

- Basic Support

Pro

Complete debt settlement toolkit for serious negotiators

- Everything in Essential

- AI Script Generator

- Creditor Intelligence Database and Guidelines

- AI-Powered Negotiation Scripts + Settlement Letter Templates

- Calendar Integration for Payment Reminders

- Priority Support

Frequently Asked Questions

Get answers to common questions about debt settlement with DebtSettle.ai

Example Case Studies (Before/After)

Examples of how users can take control of their debt settlement process (Results vary and are not guaranteed)

Case #1 — The "Mixed Debt" Win

Before

2 credit cards + 1 personal loan totaling 18,650; minimums missed for 3 months; scattered notes; anxiety about calling.

Interest rates: 18-29% APR

After

Prioritized the most flexible creditor first, used AI call script + hardship letter, then sequenced follow-ups. Settled 2 cards at 45% and 52%; set a structured plan on the loan with interest concessions. All agreements stored in the Secure Document Vault; reminders ensured every payment posted on time.

Time to complete: 8 months

What Made the Difference:

- AI Scripts & Letters for first call, counter, and finalization" account first

- Budget Planner to set realistic lump sums and payment schedules

- Debt Tracker to log offers, counters, due dates

- Document Vault kept all settlement agreements organized

Case #2 — The "Charged-Off & Collections" Plan

Before

4 charged-off accounts in collections totaling $12,400; no system, missed callbacks, lost PDFs of prior offers.

Legal threats increasing

After

Imported accounts, tagged as charged-off, and targeted agencies with historically higher settlement ranges. Negotiated three settlements averaging 35% and set a 3-month payment plan on the fourth. Timeline: 60–90 days. Every letter and final agreement stored in the Document Vault; visual progress tracker showed % of total resolved.

Time to complete: 60-90 days

What Made the Difference:

- AI Letter Templates (initial offer + counter + pay-for-delete request where appropriate)

- Payment scheduling prevented deals from falling through

- Creditor Intelligence to set realistic target ranges by agency

- Automated reminders + Document Vault for clean documentation and compliance

Case #3 — The "Multi-Debt Playbook"

Before

7 unsecured accounts totaling $42,800

- Credit Card A: $14,800 (60 days past due)

- Credit Card B: $9,200 (charged-off)

- Retail Card: $2,900 (90 days past due)

- Personal Loan: $11,500 (current but unaffordable)

- Medical Collections: $3,400 (in collections)

- Two Store Cards: $1,000 total (past due)

Disorganized notes, missed callbacks, no clear offer strategy or cash flow plan.

Personal guarantees on business debt

After

Sequenced outreach using Creditor Intelligence (charged-off & collections first). Set a $450/mo settlement fund + earmarked $2,500 tax refund for lump-sum "quick wins."

- Medical collections settled at 30% (paid in full with refund)

- Credit Card B (charged-off) settled at 45% over 3 payments

- Retail card settled at 50% lump sum

- Store cards settled at 40–50% combined

- Personal loan restructured with interest concession + lower payment

Timeline: 120–150 days to resolve 6 of 7; loan restructure ongoing with on-time payments. All letters and agreements stored in Secure Document Vault; Debt Tracker showed ~46% weighted-average settlement on resolved accounts and on-time reminders prevented any missed follow-ups.

Time to complete: 120-150 Days

What Made the Difference:

- COVID hardship documentation and scripts

- Prioritization engine to target best-odds accounts first

- AI Scripts & Letter Templates (initial, counter, finalization) tailored to each creditor type

- Budget Planner to lock realistic lump sums and monthly commitments

- Automated reminders + Document Vault for clean documentation and compliance

Ready to write your own success story?

Start Your 14-Day FREE TrialStart Your 14-Day Free Trial

Enjoy DebtSettle.ai Risk-Free for 14 Days. If you decide not to continue, you can cancel your subscription at any point, and your card will not be charged. It's that simple.

Ready to take control of your debt?

Join DebtSettle.ai today and successfully negotiate your way to financial freedom!

Start Free Trial Learn More